The PBR25 Top Buy Stocks February 2020 Report Card

By Larry C. Paxton

Welcome to the 12 Month Report Card for The PBR25 Top Buy Stocks for February 2020.

As investors we count on professional stock analysts to provide comprehensive and diligent research to come up with their best take on how stocks will perform over the next 12 months. We then use that information to help us make stock buy, hold and sell decisions.

The PBR25 Premise

The premise of The PBR25 is there is a high probability of success for stock investing when a large enough number professional stock analysts through their extensive research determine that a stock is a “Buy” and also forecast a significant return over the next 12 months.

Last 12 Months Influences

Since February 2020 a lot has happened that was not predicted and not part of their analysis at that time:

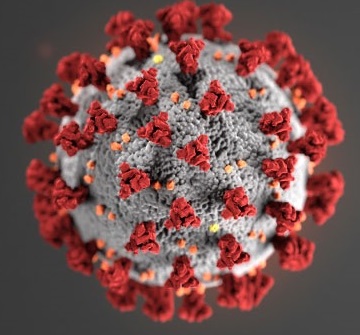

- The world and the US was hit with the COVID-19 pandemic that continues to take lives in large numbers, has affected economies worldwide, resulted in millions of lost jobs, and stressed healthcare, education, and businesses beyond imagination, with major uncertainties that remain today for individuals and organizations of all types.

- There was a lot of civil unrest in the US from the unfortunate and graphic death of a black man, George Floyd. Other incidents followed that has made the US take more seriously racial injustice issues and accentuated concerns about income and opportunity inequalities.

- There was a very contentious US Presidential campaign that exacerbated how fractured the US is politically.

There is a lot more that can be said, but this is not meant to be an opinions post. It is a piece focused on the review of the recommendations stock analysts came up with around late February 2020 and the actual results 12 months later around the end of February 2021.

Creating The PBR25 Top Buy Stocks List for February 2020

The starting point is the prestigious The PBR1000, produced monthly by PBRMarketTools. To be included in The PBR1000 the 1,000 companies must meet the following criteria:

- The companies must be publicly traded on the NYSE, NYSE American or NASDAQ stock exchanges, with a very few temporarily trading on the Over-The-Counter market because they are transitioning from bankruptcy.

- They must be headquartered in the US, or have primary operations in the US.

- They must have generated at least $1 billion in revenues in their most recent full fiscal year.

- They must file an annual 10-K form with the US Securities and Exchange Commission in US dollars

- Each of the 1,000 companies is given a primary ranking based on revenues, with the company having the highest revenue amount ranked 1(currently Walmart). There are 27 secondary rankings in The PBR1000 based on other criteria as well.

Each month the 12 month estimates and recommendations by stock analysts are updated on The PBR1000. The PBR25 Top Buy Stocks list for February 2020 was then created using the following process:

- At any point in time The PBR1000 has around 15,000 stock analyst recommendations.

- The PBR1000 was sorted by stock analyst recommendations.

- Those stocks rated a “Buy” were then further sorted by the number of “Buy” recommendations.

- For February 2020 a cut off of at least 14 “Buy” recommendations was then sorted by each stock’s weighted average, with a Buy being worth 5 points, Overweight 4 points, Hold 3 points, Underweight 2 points and Sell 1 point. The maximum weighted average is 5.00. For a stock to achieve a “Buy” recommendation its weighted average must be greater than 4.50.

- The PBR25 Top Buy Stocks list was finalized by doing a descending sort by the weighted averages.

Characteristics of The PBR25 Top Buy Stocks for February 2020

- The PBR25 data for February 2020 is actually from February 28, 2020

- Revenue rankings were from 2(Amazon) to 897(Parsley Energy, which was acquired during the following 12 months. Prologis was next lowest, ranked at 688.)

- Market capitalization(company stock value) ranged from $5.16 billion(OneMain Holdings) to $1,203.13 billion(Amazon). Total market capitalization for all The PBR25 Top Buy Stocks was $4,874.72 billion

- Weighted averages ranged from 4.96 to 4.65, the average was 4.74, on the 5.00 scale.

- 15 companies traded on the NYSE, 8 companies on NASDAQ, 1 company on the NYSE American

- 7 companies were energy related companies, 6 companies were technology related companies, 4 were financial services companies, 2 were retailers, 2 were healthcare related services, 1 was a construction services company, 1 was a live sciences company, 1 was a real estate investment trust

- Per share stock prices on 02/28/20 ranged from $11.08 to $1,883.75. The total for all 24 of the 25 stocks used was $6,121.07

- 12 month targeted stock prices ranged from $19.05 to $2,412.00. The total for all 24 stocks used was $7,815.97

- The total average forecasted 12 month change was +$1,694.90, for a percent change of +27.69%

Actual Results for The PBR25 Top Buy Stocks for February 2021

- The data is from Friday, February 26, 2021

- One energy related company was acquired during the 12 month period. This analysis is based on the 24 remaining companies.

- Per share stock prices on 02/26/21 ranged from $7.64 to $3,092.93. The total for all 24 stocks used was $8,732.02

- The 12 month actual difference was +$2,610.95, for a +42.66% change

- Actual 12 month change ranged from -38.26%(an energy company) to +140.62%(a financial services company), the median was +20.05%

- 8 companies exceeded the forecasted 12 month average change, 16 companies did not

- 20 companies had a positive gain, only 4 companies had a loss

- 6 of the 16 companies that did not meet the forecast were energy related

- The PBR25 Top Buy Stocks achieved a +42.66% gain over the 12 months while the 3 major US stock indices had the following results: DJIA +21.74%, NASDAQ +53.98%, S&P500 +29.01%

Conclusions, Observations, Validations and Realities

- If you had bought 1 share each of The PBR25 Top Buy Stocks at the closing price on February 28, 2020, you would have achieved a +42.66% gain at the close on February 26, 2021, an excellent return

- The stock analysts +20.05% median result was below the forecasted +27.69% 12 month target, but there was a very wide fluctuation on both sides of the median

- It is difficult to forecast out 12 months with any great accuracy, there are just too many variables and uncertainties, but it can be useful and helpful in providing some guidance

- It does demonstrate that The PBR25 Top Buy Stocks is a valid methodology and process for that particular month.

- Our demonstration account, called The Charlie Fund, uses the popular “Buy & Hold with Consistent Monthly Investment Strategy” with the monthly The PBR25 Top Buy Stocks as the primary research tool. It achieved a +46.62% return in 2020, a further validation of the methodology.

- There are no guarantees! The reality is that there will always be ups and downs in the stock market and people make stocks buy, hold and sell decisions based on a wide range logical and emotional criteria, input from knowledgeable hard-working experts and well meaning friends, and if the sky is blue today. But the historical data is pretty convincing that stocks will trend up at an above average investment rate over the long haul.

Additional Information

- The details of this summary, including company names and the over 200 fields of information for each company, were extracted from the updated The PBR25 Top Buy Stocks MS-Excel worksheet for February 2020, and has been distributed to The PBR25 Top Buy Stocks Subscribers for their personal use and further research

- For characteristics of the most recent monthly The PBR25 Top Buy Stocks go to The PBR25 Top Buy Stocks information page.

We are always interested in your feedback, which you can provide on the Contact Us page.

PBRMarketTools.com provides The PBR1000, a compilation of 1,000 of the largest publicly held companies with primary operations in the US. These companies generate $15 trillion in annual revenues, more than all other US companies combined. The PBR1000 Monthly Snapshots provides these 1,000 companies in Excel format, includes 15 worksheets with 28 rankings, over 200 data/information points, hotlinks to key data, and important news items per company. The monthly The PBR25 Top Buy Stocks is a subset of the monthly The PBR1000 and is available as a separate monthly or annual subscription.

Disclaimers: The PBR1000 is compiled from a variety of publicly available resources. As such, PBRMarketTools.com is not responsible for the data itself. Any liability for the representations or decisions based on the data is solely the responsibility of the authorized user, not PBRMarketTools.com, its employees or affiliates. PBRMarketTools.com is an independent business intelligence service providing news, data, and analysis. It is not a financial advisory or stock brokerage firm and has no affiliation with such organizations. Any opinions expressed should not be regarded as advice.

Empowering Shrewd Investors Through The PBR1000 Analytics!

Copyright © 2021 by Pax Business Resources, LLC, All Rights Reserved.